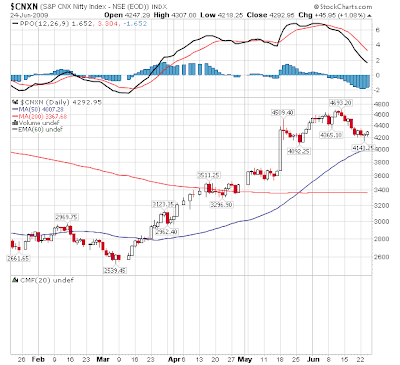

After the Fed's decision to hold interest Rates at 0 % , currently at 0.25% , Oil and Base metals including precious metals fell due to a stronger dollar . Resistance Nifty 4436 T1 Nifty 4664 T2 Nifty 5000 T3 Nifty 5200 T4 Support Nifty 4183 Nifty 3900 Looking at the Daily nifty Chart, it looked like a volatile day ahead, The markets crashed to 4226 levels, because of a stronger USD. ------------------ Bulls Will be Back . We expect july to be a positive month , July would bring nifty to its 5200 levels, with the prices of oil rising to $76 USD from its current price of $66 USD The economic outlook looks much better , this month should also be good for precious metals and bse metals, We should see huge volumes in Gold ETF funds, and most of the people who cancelled their SIP plans are already starting to rush back picking them up again . Gold SIP plans are the hottest this year. Since the production on gold has stalled , and due to incresing demand in gold , we should see its prices by about $1200 by the end of december. or perhaps much before , don't be surprised to see gold hitting $1036 before the month of september , We are also expecting oil to hit $117 withint september, once oil hits a target of $117 , it is possible that we could see a correction in the Equity markets during the month of October.

Nifty Weekly

The Weekly Chart shows signs of the Nifty spiking up towards 5200 , once waiting for volume to decrease, this probably would be the pre - post budget move, or perhaps the move during the budget.

Power , Infra , Healthcare , Pharma .. are secotrs which are looking good for the coming budget.

which will bring the Nifty Index towards the 5200 mark ,

Happy Trading.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.