Bulls Make Money , Bears Make money , Pigs get slaughtered....

Latest Economics Events

Technical Market View

Monday, March 22, 2010

Stock Picks! 22 March 2010

The Euro fell on Friday for the third session in a row accumulating a decline of 230 pips.

EUR/USD failed to consolidate above 1.3800 and weakened erasing early gains and finished the week with an important decline. The pair had the first weekly close below 1.3550 in ten months.

“The EUR may be vulnerable widening of yield and growth differential as rumors are circulating that the Fed hiked the discount rate before the next policy meeting in April. EUR traded to the days lows pressured by report that India hiked interest rates”

Nifty has resistance at 5293

It is possible that we might witness a crash in the markets with high selling pressure.

Short selling high beta value stock's would be risky and highly profitable.

List of High beta value stock's are mentioned below.

DLF LIMITED 1.56

HINDALCO INDUSTRIES LTD 1.32

ICICI BANK LTD. 1.50

JAIPRAKASH ASSOCIATES LIMITED 1.58

RELIANCE INFRASTRUCTURE LTD 1.45

TATA STEEL LIMITED. 1.46

----------------

Stock Picks For 22 march 2010

JB CHEM PHARMA buy with stop loss of Rs.69.00

JSL Buy with a target of Rs.110

SUNFLAG buy with stop loss of Rs.30.80

SUZLON (Buy)

IOC (Buy)

IOB (Buy)

Golden Tobacco (Buy with a target of Rs.133)

FDC (Buy)

ETC entertainment (Buy)

DEWANHOUS (buy only above Rs.203)

AUTOIND buy above Rs.118 only

CREWBOS (Buy)

buy Advanta (Intraday only)

Saturday, September 12, 2009

Market watch

Commodity prices rose modestly last week amid weakness in USD. Reuters/Jefferies CRB Index added +1.4% while USD Index plunged almost -2% to 76.6, the lowest close in a year. Commodities normally trade in opposite direction with the dollar.

The generation-low interest rate in the US (Fed funds rate: 0-0.25%) has caused massive selloff in USD. Against the euro, the greenback plunged for 4 out of 5 trading days and closed -1.9% lower at 1.457, the lowest level in 9 months, for the week. Against the pound, USD also slid -1.6% to 1.6655, a 1-month low, last week.

There were 3 central bank meetings last week. All of the RBNZ, BOE and BOC left interest rates unchanged at 2.5%, 0.5% and 0.25% respectively during the meetings but policymakers indicated brighter economic outlooks for 2H09 and 2010.

In the coming week, the BOJ and SNB will decide on rates. We believe both banks will leave policy rates unchanged at 0.1% and 0.25% respectively. This would leave the markets range bound before the release.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------

After spiking to 72.9, crude oil tumbled to as low as 68.8. The October contract plunged -3.9% to settle at 69.12 Friday, leaving this week's gain to +1.2% only. The black gold's decline Friday was accompanied by the dollar's weakness and strong US economic data. These were in contrary to the usual inverse relationship between commodities and USD.

Crude oil started the week with strong rally but ended it with a slump. We believe the reversal was not only due to profit-taking but also a delayed reaction to the industry news/data released during the week.

Both the industry-sponsored API and the US Energy Department reported huge draw in crude oil inventory but surprising increase in gasoline and distillate stockpiles. Although decline in crude inventory positive, surges in fuel storage should have more than offset bullishness.

Gasoline stockpile rose +2.1 mmb last week to 207 mmb. This had not only come in contrary to consensus of a draw but also halted the 6 consecutive weekly declines. In fact, we believe further increase in stockpile will follow in coming months due to the normal shoulder season in the 4th quarter. Distillate stockpile gained for the 3rd consecutive week. Since 3Q09, inventory has risen for 8 out of 10 weeks. As winter comes, demand for heating oil should increase but this may not be the case this year. Meteorologists suggested the possibility of El Nino which may bring a warmer-than-expected winter in the Northern Hemisphere this year.

OPEC concluded September's meeting and announced to keep production quotas unchanged Wednesday. Apparently, the meeting was a non-event as the outcome was widely anticipated. However, comments from member countries, especially Saudi Arabia, suggested OPEC's goal to tighten stock level has been dropped.

After the meeting, Saudi Arabia's oil minister Ali al-Naimi commented that 'we are enjoying a good, fair price' and 'Inventories are irrelevant, they can be 70 days... It has no bearing on price'. This was compared with the comment in May that industry-held stockpiles in developed nations needed to be brought down to the equivalent of about 52 to 54 days worth of consumption, from 62 days. Concerning compliance, Ali al-Naimi did not see the need to put pressure on overproducing members as 'people are complying anyway, 70% compliance is great'.

Obviously, the members were satisfied with the current price level and Saudi Arabia explicitly mentioned that the current 68-73 level is 'going to be there for a while'. Giving the OPEC's significance in affect oil price, we do believe that the current price level can hold in the medium term. The members will increase output should oil price increases. When price drops, say below 60, large producers such as Saudi can reduce supplies, thereby limiting the fall. In this way, crude oil price will consolidate for some time, given global economy improves in a gradual but uncertain manner.

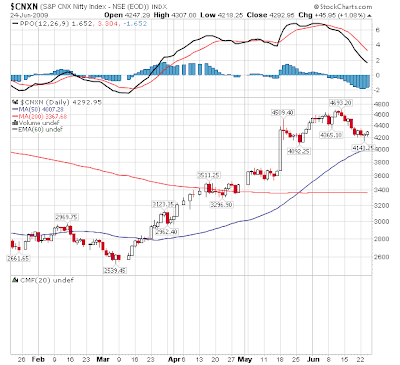

Thursday, June 25, 2009

The Nifty Daily

After the Fed's decision to hold interest Rates at 0 % , currently at 0.25% , Oil and Base metals including precious metals fell due to a stronger dollar . Resistance Nifty 4436 T1 Nifty 4664 T2 Nifty 5000 T3 Nifty 5200 T4 Support Nifty 4183 Nifty 3900 Looking at the Daily nifty Chart, it looked like a volatile day ahead, The markets crashed to 4226 levels, because of a stronger USD. ------------------ Bulls Will be Back . We expect july to be a positive month , July would bring nifty to its 5200 levels, with the prices of oil rising to $76 USD from its current price of $66 USD The economic outlook looks much better , this month should also be good for precious metals and bse metals, We should see huge volumes in Gold ETF funds, and most of the people who cancelled their SIP plans are already starting to rush back picking them up again . Gold SIP plans are the hottest this year. Since the production on gold has stalled , and due to incresing demand in gold , we should see its prices by about $1200 by the end of december. or perhaps much before , don't be surprised to see gold hitting $1036 before the month of september , We are also expecting oil to hit $117 withint september, once oil hits a target of $117 , it is possible that we could see a correction in the Equity markets during the month of October.

Nifty Weekly

The Weekly Chart shows signs of the Nifty spiking up towards 5200 , once waiting for volume to decrease, this probably would be the pre - post budget move, or perhaps the move during the budget.

Power , Infra , Healthcare , Pharma .. are secotrs which are looking good for the coming budget.

which will bring the Nifty Index towards the 5200 mark ,

Happy Trading.